Introduction

In today’s dynamic business landscape, safeguarding your enterprise against unforeseen risks is paramount.

Business insurance acts as a protective shield, ensuring that companies can navigate challenges without compromising financial stability. MyWebInsurance.com emerges as a pivotal platform, simplifying the acquisition of tailored insurance solutions for businesses of all sizes.

This article delves into the significance of business insurance, the unique offerings of MyWebInsurance.com, and addresses common queries to guide business owners in making informed decisions.

Understanding Business Insurance

Business insurance encompasses a range of policies designed to protect a company’s assets, income, and operations from various risks. Key types include:

- General Liability Insurance: Covers claims related to bodily injury, property damage, and advertising injury.

- Commercial Property Insurance: Protects physical assets like buildings, equipment, and inventory from damages due to events like fires or theft.

- Professional Liability Insurance: Also known as errors and omissions insurance, it safeguards businesses against claims of negligence or inadequate work.

- Workers’ Compensation Insurance: Provides medical and wage benefits to employees injured during employment.

- Business Interruption Insurance: Compensates for lost income when unforeseen events disrupt normal business operations.

Read More: Empowering Communities | How Fighting for Futures is Changing Lives

Why Choose MyWebInsurance.com?

MyWebInsurance.com distinguishes itself in the insurance landscape through several key features:

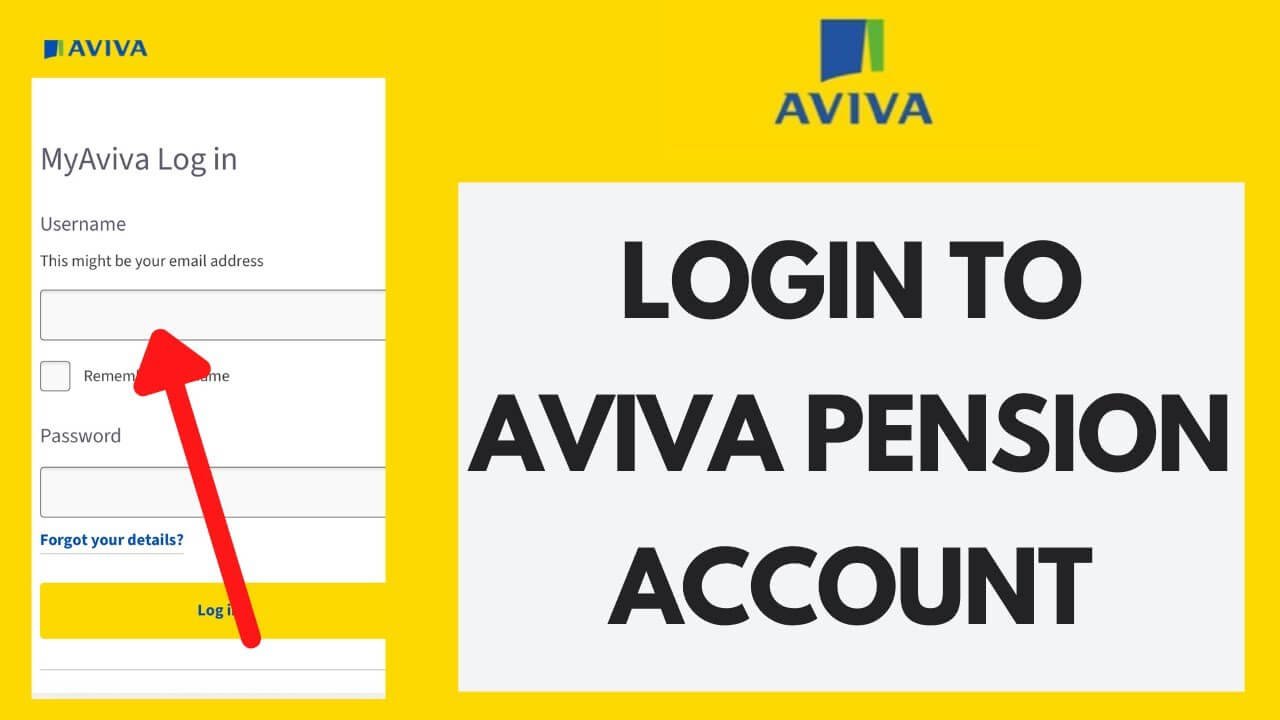

- User-Friendly Platform: The platform offers an intuitive interface, allowing business owners to compare policies, obtain customized quotes, and purchase coverage seamlessly.

- Customized Coverage: Recognizing that each business has unique needs, MyWebInsurance.com provides tailored insurance solutions to match specific industry requirements and risk profiles.

- Competitive Pricing: By leveraging technology to reduce overhead costs, MyWebInsurance.com offers affordable premiums without compromising on coverage quality.

- Expert Support: Beyond technological efficiency, the platform ensures access to knowledgeable agents who provide personalized assistance, ensuring clarity and confidence in decision-making.

Key Features of MyWebInsurance.com’s Business Insurance Policies

- Instant Quotes: Businesses can receive real-time, personalized quotes by inputting essential details, facilitating swift decision-making.

- Flexible Payment Plans: To accommodate varying financial situations, the platform offers multiple payment options, including monthly, quarterly, or annual plans.

- Comprehensive Risk Assessment: Utilizing advanced algorithms, MyWebInsurance.com evaluates a business’s risk factors to recommend optimal policy options.

- Policy Bundling: Clients can bundle multiple policies, such as general liability and property insurance, into a single package, often resulting in cost savings.

Benefits of Business Insurance

Investing in business insurance through MyWebInsurance.com offers several advantages:

- Financial Security: Insurance protects businesses from significant financial losses due to lawsuits, property damage, or employee injuries.

- Legal Compliance: Many jurisdictions mandate certain types of insurance, such as workers’ compensation. MyWebInsurance.com ensures businesses remain compliant with these regulations.

- Enhanced Credibility: Having appropriate insurance coverage enhances a business’s credibility with clients, partners, and investors, showcasing professionalism and preparedness.

- Peace of Mind: Knowing that potential risks are covered allows business owners to focus on growth and operations without constant worry.

Case Studies: Real Businesses, Real Success

- Tech Startup: A small tech company faced potential intellectual property lawsuits. Through MyWebInsurance.com, they secured affordable professional liability insurance, safeguarding their operations and enabling confident scaling.

- Retail Store: After experiencing a burglary resulting in significant inventory loss, a retail store utilized their commercial property insurance from MyWebInsurance.com to recover swiftly without financial strain.

- Construction Company: Facing workers’ injuries across multiple sites, a construction firm obtained workers’ compensation insurance through MyWebInsurance.com, ensuring employees received necessary care while protecting the business from costly lawsuits.

Emerging Trends in Business Insurance

The business insurance landscape is continually evolving. Notable trends include:

- Rise of Cyber Liability Insurance: With increasing digitalization, businesses face heightened cyber threats, making cyber liability insurance essential.

- Sustainability and Green Insurance: Eco-conscious businesses are opting for policies that cover risks specific to sustainable operations, such as renewable energy installations.

- Flexible Coverage Options: Insurers are offering on-demand insurance, allowing businesses to activate coverage only when needed, benefiting seasonal or fluctuating operations.

How MyWebInsurance.com Stays Ahead

To remain at the forefront of the industry, MyWebInsurance.com employs several strategies:

- Technology-Driven Solutions: The platform utilizes advanced algorithms and data analytics to provide accurate risk assessments and tailored policy recommendations.

- Continuous Learning: MyWebInsurance.com consistently updates its offerings to align with emerging risks and industry trends, ensuring businesses are always protected against current threats.

Conclusion

In an unpredictable business environment, securing comprehensive insurance coverage is not just a precaution but a necessity. MyWebInsurance.com stands out as a reliable partner, offering customized, affordable, and comprehensive insurance solutions.

By choosing MyWebInsurance.com, businesses can focus on growth and innovation, confident in the knowledge that they are protected against unforeseen challenges.